Web design

Stunning Websites That Tells Your Story

Where Less is More

SEM Digital knows your website is more than just an online presence; it’s the cornerstone of your brand and the first impression for many potential clients. We understand that every business, regardless of size or industry, has a unique brand, image, and story that must be told to truly “be found.” Our passion lies in helping you craft and communicate that focused message—the why behind your business, who you serve best, and what sets you apart from the competition.

Contact Us Now and Let Our Website Design Blow Your Prospects Away!

We move beyond cluttered designs and overwhelming information. At SEM Digital, we embrace the philosophy that “less is more.” We strategically utilize just the right amount of compelling emotional imagery, engaging video, and impactful text to draw in curiosity and, more importantly, drive action.

Responsive Website Design: Seamless Across Every Device

Mobile-first websites that look and functions flawlessly on every device is non-negotiable. Our responsive website designs ensure your message is beautifully presented and easily accessible whether your audience is on a desktop, tablet, or smartphone. We create experiences that adapt, keeping your brand consistent and user-friendly.

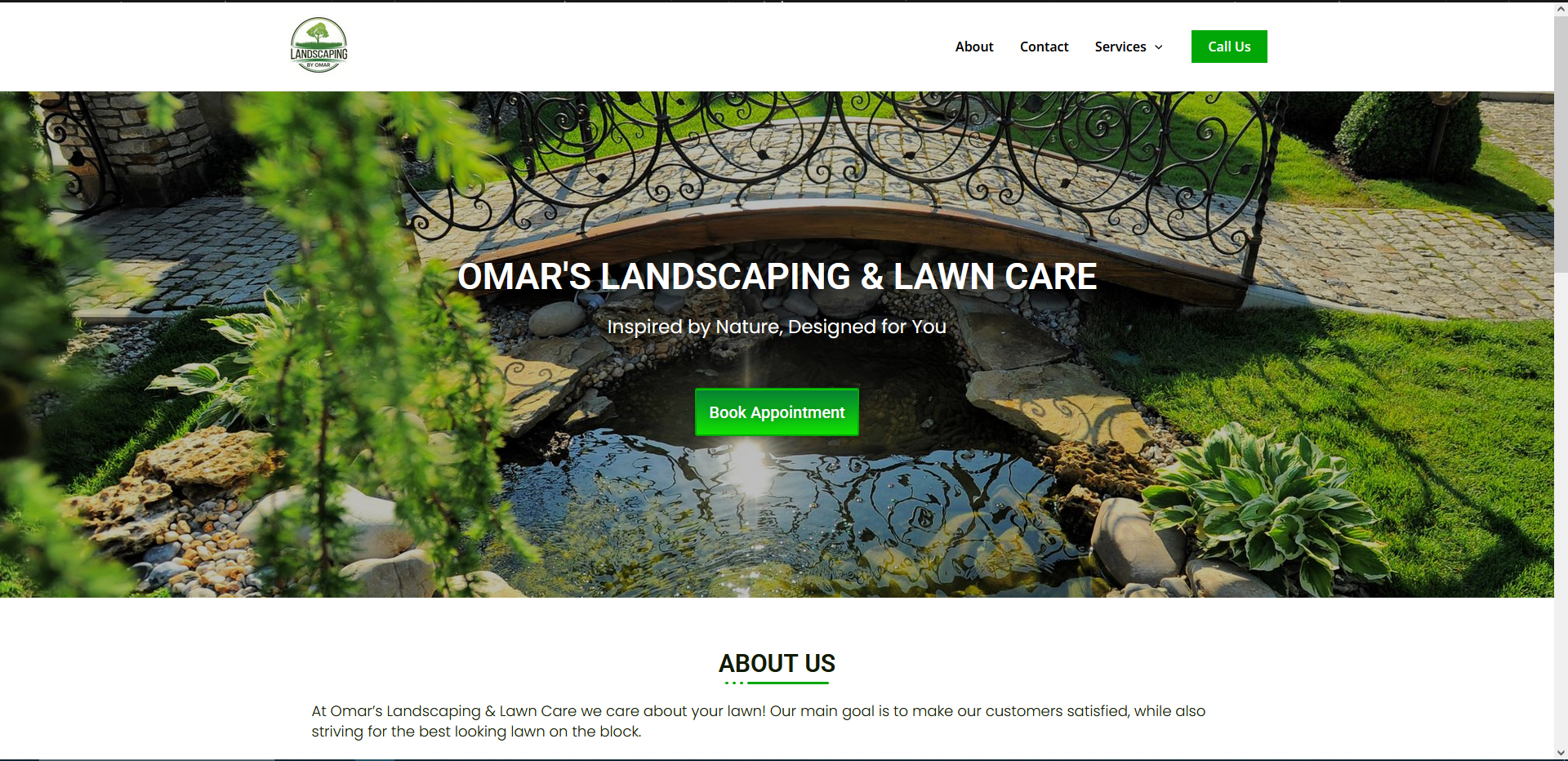

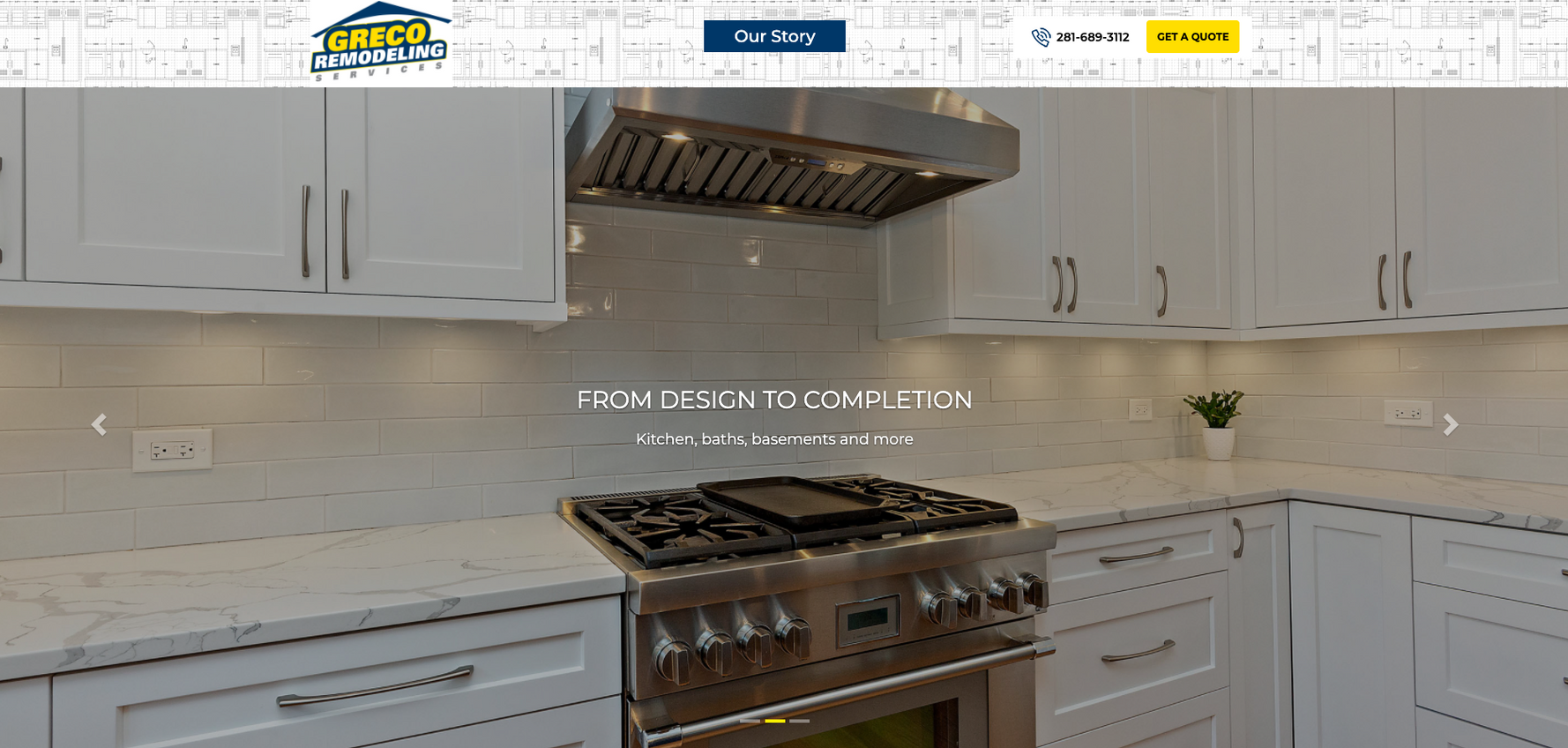

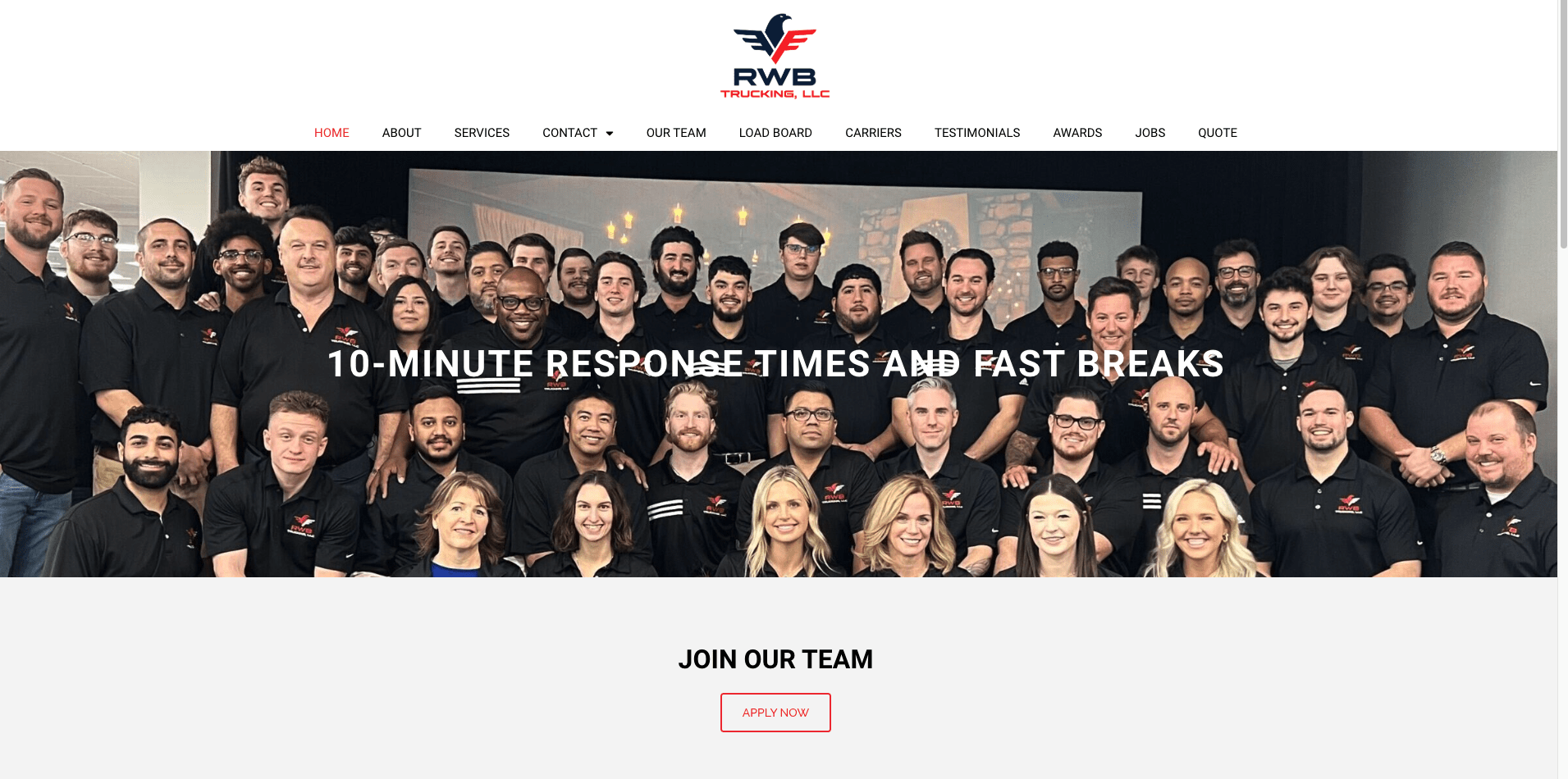

Portfolio

Powering Your Success with WordPress

We build powerful and user-friendly websites, leveraging the flexibility and scalability of WordPress, the world’s leading content management system. This allows for easy updates and management of your site, putting you in control of your online presence.

SEO-Ready from the Start: Designed to Be Found

Your beautiful website needs to be seen. That’s why every website we design at SEM Digital is built with SEO best practices in mind. We ensure your site is technically sound, optimized for search engines, and guaranteed to set you apart from your competition in search results. We harness the fundamentals of effective web design with a modern twist to create a website that looks fantastic and performs exceptionally well.

Your Website: A Critical Business Asset

Take a moment to consider your current website. Does it accurately represent your brand? Does it effectively convert visitors into valuable leads and ultimately into sales? Does it consistently bring in new business? Do you even know?

Your website is a crucial tool for growth; if it’s not performing at its best, you’re missing out. Just like life, a website must have a purpose. At SEM Digital, we design websites with a clear objective—to attract, engage, and convert your ideal customers.

Ready for a Website That Blows Your Prospects Away?

Don’t settle for a website that exists. Let SEM Digital create a powerful online presence that truly reflects your brand, drives results, and positions you as a leader in your industry.

Contact us now for a consultation and let our website design experts at SEM Digital create a website that will blow your prospects away! We are not satisfied unless your satisfied.